Nomads and Taxes: Navigating a Borderless Lifestyle

Unravel the complexities of taxes for digital nomads—how tax residency works, common challenges, and what it means to live a borderless life.

This post is part of an essay collection. You can buy the book version on Kindle or subscribe on Substack for new essays.

“I hear people talking the language of participation and justice and equality and transparency, but then almost no-one raises the real issue of tax avoidance…It feels like I’m at a firefighter’s conference and no one’s allowed to speak about water. This is not rocket science. We can talk for a very long time about all these stupid philanthropy schemes, we can invite Bono once more, but come on, we’ve got to be talking about taxes. That’s it: taxes, taxes, taxes. All the rest is bullshit.”—Rutger Bregman, Historian & Bestselling Author

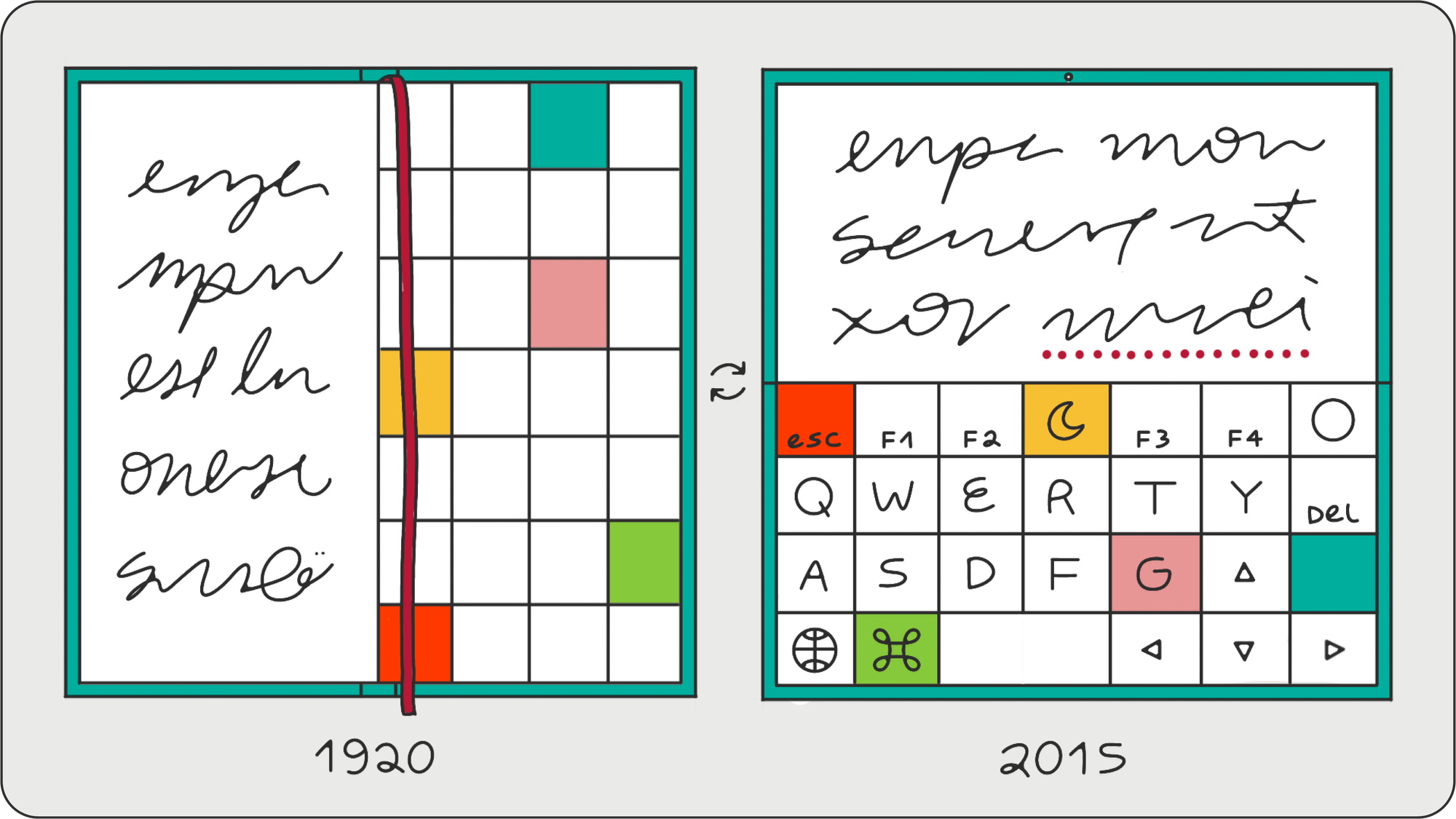

Who pays what to whom, and when, is hard enough to figure out when you still live in the town where you grew up. Frequent or infrequent relocation, dual or multiple citizenships, and other features of global, remote work challenge tax norms. Who we pay taxes to has traditionally been about where we live and work, but the internet has made the “where” part more difficult to pin down.

Taxes can be hyperlocalized: If you live in an area where people are well-off and pay more into the system, there are better services available—from recycling facilities and good schools, to road infrastructure and community spaces. But you also pay taxes into your nation’s military whether or not you want to go to war, and into its arts programs whether or not you love the theater, and into its scientific research whether or not you believe in evolution or vaccination. So, what does it mean—and how do taxes work—when you see yourself as a global citizen?

Let’s look at an example. If a nomad with a German passport is based in Vietnam for six months and works remotely for a US company, the tax implications quickly become complicated. Our nomad is likely registered with the German authorities for income taxes, and their US employer will transact with them as a German resident and pay their salary into a German bank account.

If our nomad has their own self-employed business entity to receive their income, it will likely be in Germany rather than Vietnam. So, Vietnam doesn’t benefit from the US company’s business taxes or from our German nomad’s income taxes. If our nomad is living in Vietnam and using the local infrastructure, though, shouldn’t they be obliged to pay taxes there? The intuitive answer is yes, but the reality is more complicated than a simple ‘yes’ or ‘no.’

Many nomads “offshore” their incomes, meaning their tax obligations are in a different jurisdiction than they are physically present. At first, a nomad usually registers their employment or business—and therefore pays income taxes—in their country of origin, then works remotely from different places on an informal basis. Later, some may choose to move their business entity to one of fifteen jurisdictions that leverage no corporate taxes at all, or their employment to a country in which workers pay no income taxes.

Right now, it’s also possible—and perfectly legal—to live and work as a digital nomad and pay no income taxes at all. People achieve this by staying only a few months in each country, which means that no jurisdiction has a claim to their salary. Some people argue that nomads live in a community with almost no obligation to it; their income is sent elsewhere—either “back home” or to a third country where they have registered for taxes, or they are never even eligible to pay taxes to begin with.

This offshoring problem, of course, is not exclusive to nomads. The tactics were pioneered by the ultra-wealthy and their accountants to achieve “tax efficiency,” and then adopted by nomads searching for the best way to handle their affairs. But by no means are all nomads seeking to opt out of any tax system. Some nomads may decide that paying taxes in their country of origin is the best option—they may choose to pay taxes where they have family. For others, it may be neither simple nor sensical to do so. If a nomad with a Serbian passport spends no time at all in the country each year, uses no government service, doesn’t vote in the country’s elections, does it make sense for them to pay taxes in Serbia? In many cases, there is just no tax infrastructure suitable for nomads.

Tax avoidance is a widespread and controversial issue, and many people, nomads included, do intentionally offshore their financial affairs to keep more of their earnings. The global tax system has many loopholes and has not kept pace with how people live and businesses operate.

For most nomads, though, the bigger motivation for separating physical and tax location is sidestepping bureaucracy. The complexity and commitment of registering on the ground in most places leads nomads to choose a single jurisdiction in a language they speak, and stick with it for several years. In many examples, the business and income tax rates of a host country are actually lower than a nomad’s country of origin, but language barriers, cultural differences, and the burden of local administration make a formal arrangement unappealing. If registering to pay local income taxes were as simple as swiping a contactless travel card on a subway system, more nomads would do it.

The same moral arguments against offshoring taxes from wealthy countries to tax havens apply to nomads’ actions as wealthier-than-average residents in poorer countries: it deprives local populations of the revenues needed to fund economic development and create a better, fairer society. But income taxes are only one part of the story. Depending on whether a person is classified as a local resident or temporary visitor, they are obliged to pay various different taxes:

- Income taxes: charged on a person’s individual earnings

- Infrastructure taxes: charged to maintain public transport, water supply, trash and recycling services, hospitals, and other essential infrastructure

- Consumption taxes: charged on local spending and transactions, often called Value-Added Tax or sales tax

- Tourist taxes: charged on visitors’ stays, usually payable per night via accommodation providers like hotels or serviced apartments

Nomads pay consumption taxes on their local spending and, in many countries, their classification as temporary visitors means they pay tourist taxes if a city or country chooses to charge them. Since nomads don’t pay infrastructure taxes, though, they make use of local services without giving much back to fund them. Nomads do tend to spend more money than locals on accommodation, hospitality, sightseeing, and other activities, which boosts the host community’s economy and makes them a profitable target market for new and expanded businesses.

As remote workers, nomads almost never take jobs away from the places they visit. In fact, sometimes they even create opportunities directly by starting a business or investing in one. A nomad’s global salary goes further in a low-cost destination, and beyond improving their own quality of life, nomads are drawn to the idea of investing directly in the places they like and the people they meet.

Later in the book, we’ll examine how to increase a destination’s global relevancy and competitiveness, and why this makes them such an attractive prospect for governments seeking to promote their city or country internationally. Next, though, we’ll get to know some of the early artists and writers whose vision of collaborative cross-cultural exchange has echoes in today’s nomad movement. We’ll also trace the history of digital nomads, including major figures, early predictions, and the growth of the nomadic movement to the present day.

Read the next post: